Chinese entrepreneurs focus on innovation, reshape growth priorities to offset rough headwinds

It is that time of the year when there is high tension in the air, considering that businesses are finalizing their annual figures and discussing the way forward. Though trade undercurrents from Europe and the US have been frosty, policymakers in Beijing have more than enough reason to rejoice as the success of some private enterprises in overseas markets has managed to ward off some of the chill.

Though the recent tirades in the US and Europe against Chinese telecom equipment and solar panel makers are clear indications that the private sector is not immune to external threats, the determination of the companies to press ahead with their global plans indicates that private entrepreneurship in China is blossoming, thriving and moving on to newer markets and regions.

The robustness was more than evident when China zoomed past Japan in the latest Fortune Global 500 rankings to occupy the second slot with 73 companies on the list. Although the majority of Chinese companies on the list continued to be State-owned companies, private enterprises are slowly catching up. Five Chinese private companies are present in the rankings this year, compared with three in 2011.

Ping An Insurance Group Co of China Ltd was the highest ranked Chinese private enterprise on the list at 242nd, a considerable jump from its 2011 ranking of 328th. Huawei, the telecom gear maker, was ranked 351st while Jiangsu Shagang Group, the largest domestic private steelmaker by sales, came in at 346th.

Textile company Shandong Weiqiao Pioneering Group at 440th and automaker Zhejiang Geely Holding Group at 475th were the debutants in this year's rankings.

"Although China's overall economic growth rate has been slowing, it is still an important contributor to global economic recovery despite sluggish international trade," says Yang Wei, vice-president for China operations at global consulting firm Accenture.

"If China's economy can realize its growth target of 7 percent and above in the consequent years, Chinese companies will easily overtake their US peers in the Fortune 500 rankings by 2025, while private companies will account for over one-third of the Chinese companies on the list," says Lu Jinyong, director of the China Research Center for Foreign Investment at the University of International Business and Economics in Beijing.

Hard facts

Hard facts

Private entrepreneurs are a relatively new breed in China and perhaps the ones who are most symbolic of the nation's current economic resurgence. Private companies began to be officially encouraged in China after the reform and opening-up and have since been slowly gaining in scale and reach.

According to the list of China's top 500 private enterprises in 2012, released by the All-China Federation of Industry and Commerce in August, the revenue of the top 500 private enterprises in China was about 9.3 trillion yuan ($1.5 trillion; 1.1 trillion euros) last year, a 33 percent year-on-year growth. Total assets amounted to 7.8 trillion yuan, 32 percent more compared with 2010.

Though these figures represent growth and robustness, amid a solid national economy, there are some pressure points that may prove troublesome for growth in the future.

Aside of the general prejudices against Chinese firms in the Western markets, private enterprises have also been suffering because of their relatively weak global management capabilities and lack of innovation.

Indeed, there is no doubt that many private companies have accelerated their overseas activities in the past few years, with a view to raise their profile in the international markets.

"Some private enterprises have successfully acquired leading global brands, such as Lenovo purchasing IBM's PC business and Geely acquiring Volvo's vehicle unit. These cases have demonstrated the strong desire of capable Chinese private companies to make global strides," Lu says.

In September this year, Dalian Wanda completed the $2.6 billion (2 billion euros) acquisition of US cinema chain AMC Entertainment, making it one of the most successful overseas deals by a Chinese private business.

According to company officials, the AMC deal has helped boost the culture and travel business of Wanda Group. Wang Jianlin, chairman of Wanda, in April mentioned that the group was expecting revenue from the culture and travel business to surpass 20 billion yuan this year.

"We are expecting a revenue of more than 40 billion from the culture industry in the next five years and be ranked among the top 50 culture firms globally."

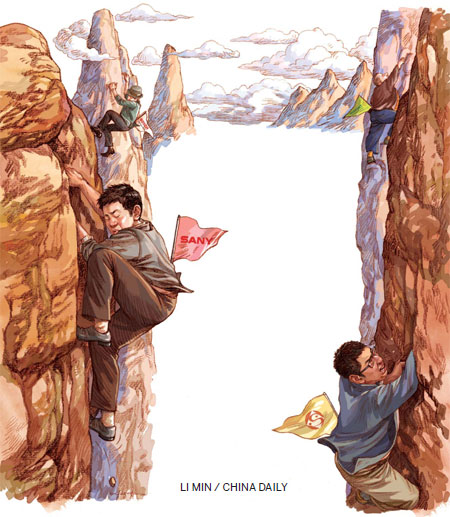

In Europe, eyebrows were raised when Sany, China's largest machinery manufacturer, acquired a 90 percent stake in German concreting machinery maker Putzmeister for 324 million euros in January.

Putzmeister had a 40 percent share of the global concrete machinery market in 2010 and nearly 90 percent of its sales came from overseas markets, according to Yengst Associates, an American market research group.

During the first six months of this year, 117 merger and acquisition deals worth about $30 billion were conducted by Chinese companies in overseas markets, according to information provided by the Ministry of Commerce.

Ouyang Xiaoming, deputy secretary-general of the All-China Federation of Industry and Commerce, says among the top 500 private Chinese companies, 150 have invested overseas, with a total investment volume of $12.35 billion, a 99.9 percent increase year-on-year.

According to the Internationalization of Chinese Enterprises Index 2012 released by China Entrepreneur magazine in the World Economic Forum held in Tianjin in September, this year has been a major milestone for Chinese businesses in the overseas markets due to the appreciation of the yuan and favorable government policies.

But going overseas has not always been easy for many Chinese companies.

Challenging task

"The general perception in Western markets is that Chinese companies are predatory, would trigger job losses and are more interested in growing market share. Such perceptions create more problems for us," says Xiang Wenbo, a director of Sany Group.

Xiang says the company faced such a situation during its recent takeover of Putzmeister, when some workers in Germany decided to strike to protest the deal.

"Our globalization strategy was conducted in an open and inclusive manner. Lack of understanding is what leads to such types of resistance," says Xiang.

Following its Putzmeister acquisition, Sany has so far not posted any Chinese employees in Germany nor taken up any major positions. "We want to leave the company as it was and to maintain its German identity," he says.

But sometimes, even the best of intentions can backfire, especially if the move does not have the backing of the government.

Sany faced such a situation recently when US President Barack Obama cited national security concerns blocking the wind-farm project of its US associate.

Ralls Corp, an associate company of Sany established in August 2010, had invested in a series of wind power projects in the US in recent years. Obama has ordered Ralls to divest its interests in a wind turbine project in Oregon, the first time since 1990 that a US president has formally blocked a business transaction over security concerns.

Not long ago, a congressional committee also urged US companies to stop doing business with two major Chinese telecom equipment makers, Huawei Technologies and ZTE Corp, because of security concerns.

These actions are despite the fact that the White House-ordered review of security risks did not uncover any evidence against Chinese companies.

Mei Xinyu, a researcher at the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce, says that mutual understanding is important for Chinese companies to succeed on the global stage. "It is more like a marriage instead of just coming and overtaking another party," Mei says.

Building bridges

To enhance cooperation with companies in the developed nations, it is important for private entrepreneurs themselves to make efforts to foster closer relations.

That Chinese companies are doing the needful in this regard was more than visible in July when, under the aegis of the China Entrepreneur Club, 30 Chinese businessmen visited the United Kingdom to foster closer links and learn from their British partners.

The combined revenues of the CEC member companies was about 256 billion euros and the visit included discussions with several important officials like British Prime Minister David Cameron and London Mayor Boris Johnson.

"The team represented the private sector, which creates the most jobs in China," said Liu Chuanzhi, founder of China's largest PC maker Lenovo and chairman of the CEC.

During the trip, the Chinese entrepreneurs visited Goodwood, Cambridge and several companies and institutions including Rolls Royce and Virgin Group, holding in-depth discussions on many issues including the global economy, sustainable development and technological innovation.

This is the third time that the club is organizing such high-level meetings. Earlier, the CEC had led similar delegations to Germany in 2010 and the US in 2011, to learn from the developed nations' business experiences and for possible future alliances, says Cheng Hong, secretary-general of the club.

Cheng says it is important for Chinese companies to further enhance mutual understanding and effective communication with non-governmental organizations.

"To the outside world, rising Chinese companies and their owners are quite mysterious. There exist some prejudices that successful business owners from China are just looking for ways to boost wealth and do not care for social responsibilities. This is a totally wrong mindset, and it is our mission to help eradicate this prejudice," she says.

Wang Chaoyong, president of China Equity Group who joined the trip, said that compared with the UK companies, many Chinese companies are quite young, like teenagers "but with great vitality".

"Every company has a dream of becoming influential and time-honored. Definitely there will be some Chinese companies that are recognized and well established worldwide in the future," Wang said.

Integration challenge

Though challenges are aplenty for Chinese companies, many of the younger players often find it difficult to properly integrate resources in the global arena, as they grow in scale.

|

| Liang Xinjun |

"In many cases, even if the Chinese companies get all the required approval for the acquisition, they find it difficult to effectively integrate the resources globally. This is a major obstacle for global expansion," says Liang Xinjun, CEO and vice-chairman of Fosun group, one of China's largest privately owned conglomerates.

Liang says that many foreign companies can allocate resources globally in an economical and profitable manner, such as choosing some countries where production costs are quite low as a manufacturing base, and selling products to the most profitable markets.

For most of the Chinese companies the overseas expansion starts with investment in overseas projects, followed by posting of Chinese employees and then repatriating the finished products to China for global sales. This is not exactly what one would call as "going global" or integration, he says.

He says what distinguishes Fosun from other companies is that it not only invests in overseas companies but also brings the foreign brands to China.

"This automatically raises the company's global brand recognition. Because of our deep understanding and the attraction of domestic market to foreign companies, this model of international cooperation has a higher possibility of success," Liang says.

The philosophy behind such moves is to marry China's growth momentum with the world's resources, he says.

"The European debt crisis has dented market confidence. But it has also provided us with much confidence to invest in overseas markets at reasonable prices," he says, adding that European and US companies that are in innovative fields such as pharmaceuticals research could be possible M&A targets.

In 2010, Fosun acquired a 7.1 percent (now 10 percent) stake, for 44 million euros, in French resort operator Club Mediterranean SA.

Liang says Fosun has helped Club Med attract more tourists and raise its profile by encouraging affiliate companies and clients to spend holidays at Club Med resorts. Club Med made a profit of 2 million euros globally last year. In 2010, it suffered a loss of 14 million euros.

Lu with UIBE says that to be successful in the global market, companies should have full understanding of the local market, laws and regulations, strong product competence and distribution competence.

"One should not be afraid to do as the Romans do. It is a good way to go hand-in-hand with foreign companies in the domestic market, as China is endowed with a fast growing middle class and growing consumption power. In the domestic market, the risks are relatively less than going to unfamiliar foreign markets."

The rising Chinese private companies are also confronted with other severe challenges such as rising raw material and labor costs as well as shrinking market demand.

These challenges, coupled with a bleak global financial situation and tight monetary policies in the domestic market, have been a temporary setback for some private companies, especially the SMEs.

Wenzhou, a city in East China's Zhejiang province known for its booming private sector, was one of the regions that was severely affected by the recent private debt crisis. Last year, about 100 leaders of private companies in the city were reported to have committed suicide or declared bankruptcy, leaving behind debts of about 10 billion yuan.

Jin Zhimian, 32, former president of Wenzhou Jinkang Optics, says the business climate in Wenzhou, especially for the SMEs, has become gloomier this year.

During an earlier interview, Jin had said that he had to lay off nearly half of his employees due to the uncertain market conditions. In July, he was forced to shut down operations after barely scraping though during the first six months.

"It is probably the most difficult period I have ever experienced in my life. It is just too hard to survive," says Jin.

New direction

But the bleak situation is also a strong impetus and a great opportunity for Chinese companies to reshape themselves and move up the value chain, something that is essential for China's future transformation, analysts say.

"Times have passed when Chinese enterprises could win market share with lower prices. Only those enterprises that can move up the value chain and provide more value-added products will survive the hard times and reap the benefits," says Xu Xiao-nian, a professor at the China Europe International Business School.

Private enterprises have already embarked on this journey and there has been a steady increase in the number of patents owned by such companies. The top 500 Chinese private companies so far own 74,631 patents this year, a 58.4 percent growth over the same period in 2010. The list also shows that 163 private companies in the top 500 have investments in new and environmentally friendly industries such as green energy.

Changsha-based construction machinery maker Sunward Equipment Group is one of the companies that is actively exploring the overseas markets as part of its efforts to further expand business. He Qinghua, founder and chairman of Sunward Equipment Group, says that the group is already in active talks with several European companies for possible merger and acquisition opportunities. "The deals will help boost Sunward's R&D capabilities and after-sales network.'

The company has also upgraded its entire product line with an eye on the export markets. The company now has more than 100 types of high-quality products for exports such as excavators, skid steer loaders, rotary drill machines, piling machinery and forklifts. According to He, Sunward's annual sales are expected to hit 20 billion yuan by 2015, with 15 to 20 percent of the revenue coming from the overseas market.

Talent shortage is another issue that has often derailed the expansion plans of many private entrepreneurs. "The talent shortage and general preference for being employed in State-owned enterprises have made it difficult for many private companies to find the right candidates for key managerial positions. In overseas markets, the problem is even more acute due to the cultural differences," Liu from Lenovo said.

For many Chinese companies, the transformation might be long and painful, as in most cases it involves huge investments and no positive effects in the short term, says Steve Tappin, a British CEO coach and the author of The Secrets of CEOs, which tracks management skills of more than 200 CEOs from across the globe.

"Take a look at the Apple outlet in Beijing's Sanlitun area. So many customers visit the shop every day. I strongly believe that soon we will see Chinese brands that are as popular as Apple in the future. But it needs patience to foster and wait. It is an unavoidable and unique way for Chinese companies to move ahead in the global stage, if they want to become the Apple of the eye for customers worldwide."

Updated: 2012-10-26 13:25

By Hu Haiyan ( China Daily)