China's rise in the global value chain is inevitable as an increasing number of companies venture out into the wider world alongside hordes of investors, keen to snap up bargains.

|

|

Heading West! This decade will see huge numbers of overseas mergers and acquisitions by Chinese enterprises, so GNP growth might not be necessarily slowing in China's coastal areas. [Photo/China Daily] |

Although there has been a wave of negative comment about China multinationals Huawei Technologies Co and ZTE Corp in some countries, notably the United States, where they have been accused of being likely to spy for the Chinese government, dampening the momentum of ambitious Chinese investors eyeing overseas markets, many believe the setback is only temporary.

"Isn't it paradoxical that many of us have learned the news via the Internet, which uses an increasing amount of equipment provided precisely by these two companies?" asked Peter Cheung, a British Chinese living in London.

Being a big fan of Chinese products, Cheung's home has seen more and more Chinese brands such as Lenovo computers and a Haier fridge in recent years, in addition to other daily necessities made in China.

"The recognition of Chinese brands may be still low here, but you can't deny the fact that customers are spending more on Chinese products," said the 33-year-old restaurant owner, adding that many of his friends have started working for Chinese companies.

Earlier, the United Kingdom said it was investigating Huawei's business in the UK after the world's second-biggest telecommunications equipment maker announced a 1.2 billion pound ($1.9 billion) investment in Britain aiming to create at least 700 jobs over the next five years, the UK's Sky News reported.

"The world needs Chinese investment as much as it needs the 'made in China' products," Cheung said.

The trend is reflected in this year's China International Fair for Investment and Trade, the world's largest stage for global investment exchange held annually in Xiamen, in East China's Fujian province, where a "revolution" was under way with the audience taking to the stage.

Traditionally an arena for Chinese projects to compete for the favors of global audiences wanting to invest in the Middle Kingdom, at least in the past 15 years of the fair's history, more attendees now decided to try to sell their own countries' projects.

Among them, 12 countries participating in the fair staged a group performance as it moved to its climax.

Henry Qin, executive vice-president of ASP Group, a facilitator of two-way cross-border economic exchanges between China and Australia, was one of the "leading actors" in this show.

"The Chinese economy and that of Australia are highly complementary, especially in the resources area," Qin said when making a presentation to potential Chinese investors.

He said the mining infrastructure in Australia is relatively underdeveloped because of inadequate investment. China's demand for resources could provide financial support in that area.

"Combining China's financial resources with the mineral resources of Australia, we'll have the chance to establish the most important mining capital market in the world," Qin said.

Australia has been the top destination for China's overseas investment since 2005, according to the Heritage Foundation, a United States think tank. Chinese investment in Australia amounted to $38.4 billion by June 2011.

Since November 2011, the Australian government has approved more than 160 projects in the area of resources, with a total investment volume of 60 billion Australian dollars ($62.2 billion), according to Qin.

In addition to Qin, others, including some from India, Russia, Italy and the United States, presented the best and unique opportunities in their countries' investment environment in the hope of taking a share of a growing Chinese cake in overseas markets.

|

|

House Intelligence Chairman Mike Rogers (left) and ranking member (Representative) Dutch Ruppersberger speak at a news conference releasing their report on alleged national security threats posed by Chinese telecommunications companies Huawei and ZTE on Capitol Hill in Washington DC on Oct 8. However, the negative comment about China's multinationals in some countries fails to dampen the enthusiasm of ambitious Chinese investors eyeing overseas markets. [Photo/China Daily] |

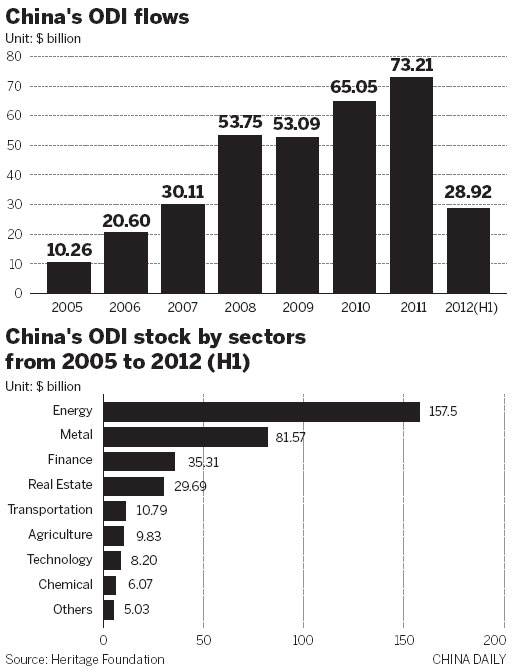

According to the Ministry of Commerce, China's outbound direct investments surged by 39.4 percent from a year earlier to $47.68 billion in the first eight months of this year.

Outbound direct investments through mergers and acquisitions maintained fast growth in the first eight months of this year and reached $13.2 billion, accounting for 28 percent of China's overseas direct investment in the same period, according to the ministry.

As the Chinese government encourages domestic enterprises to go abroad to tap international markets, China's overseas investment "experienced rapid growth or leapfrog development and will maintain fast and healthy expansion", said Shen Danyang, a spokesman for the ministry.

Going-out

China's strategic focus was to attract foreign investment in the 1990s. Foreign investment and outbound direct investment have now struck a balance in the first decade of the 21st century. This decade will see massive overseas mergers and acquisitions by Chinese enterprises, said Eddie Chan, vice-president of Invest Sweden.

Having witnessed the growth of Chinese ODI over the past 10 years, Chan has been involved in more than 100 overseas M&As. In his view, the complexity and the professional level of Chinese enterprises in dealing with these cases has been of an international standard. The volatile international economic situation presents tremendous opportunities for forward-looking companies with strategic vision.

"Overseas investment by Chinese entrepreneurs will still focus on developed countries. We will see a number of cross-border investors in the future emerging in China," said Chan.

However, along with the fast outward-going pace come doubts about the efficiency and profitability of these projects.

Shi Ziming, commercial counselor at the Ministry of Commerce's department of outward investment and economic cooperation, said 77.6 percent of the non-financial enterprises have profited from their overseas investments while 22.4 percent reported losses.

Volvo, for example, which was acquired in 2010 by Geely Group, suffered a net loss of 243 million kronor ($38 million) in the first six months of this year. In contrast, it generated a net profit of 1.2 billion kronor in the same period of 2011.

According to Chan, the overseas M&As of Chinese enterprises possess a uniqueness, unlike internal mergers within countries in the West. Chinese companies bring not only capital but the opportunities to explore the Chinese market. "It is a brand new business cooperation model," he said.

"Capital can immediately play a role when the money is there but full exploration of the market will take some time to complete," he added.

"The return period in investment in Volvo has not yet begun but, with its plant completed in China, Volvo will gradually expand the market and see a rise in sales," said Chan who was involved in the Geely-Volvo purchase.

"They (overseas M&As) are the right direction for Chinese enterprises to go in. Despite a temporarily adverse situation, they will eventually see a silver lining," he said.

While Chinese companies are anxiously looking for shelter in overseas markets, European countries are also eager to seek opportunities from the rapid economic growth in China.Updated: 2012-10-22 09:04

After Sweden and the UK became the first two countries to establish investment-promoting offices in China a decade ago, European countries have since set up more than 30 similar bureaus. "There are basically no countries that haven't done it," Chan said

Local governments in many countries including the UK and Spain have also set up a representative office in China to promote their own regions' investment opportunities.

Countries have their own preferences for industrial investment and targets. The comparatively developed countries in western Europe and Scandinavia are hoping to carry out cooperation with China in high-tech areas by virtue of their technical superiority, whereas those in southern, central and eastern Europe now mainly focus on light industry and agriculture.

A recent survey by accountancy and management consultancy firm Ernst & Young showed that Europe is still the first choice for future overseas investment by Chinese entrepreneurs. "Europe is the cradle of the Industrial Revolution (1750-1850), as well as the presenter and practitioner of the concept of sustainable development. Compared with North America, the overall policies are more open. This is what Chinese investors really need," Chan said.

"In Sweden, for example, although there is a decline in investment flow from China this year, the quality of cooperation keeps growing in such areas as new energy, the automobile industry, mobile communications and the advanced manufacturing field," said Chan.

The United States is also a favorite destination for Chinese investors. "In 2012, Chinese investment in the US will double the amount of last year and it will keep doubling for some time to come," said Harley Seyedin, president of the American Chamber of Commerce in South China.

"Certainly, I think, especially now, there are tremendous opportunities for Chinese investors in the fields of resources, energy, airspace and acquisition of companies with advanced technology. Right now US companies need cash and investment.

"Chinese companies can learn from their partners... and invest in US companies and then bring their products back to China to meet the huge market."

Chinese investment in the US jumped 38.5 percent from a year earlier to $1.81 billion in 2011. Meanwhile, China's overall outbound direct investment was $74.65 billion last year, according to the 2011 Statistical Bulletin on China's Outbound Direct Investment jointly released by China's Ministry of Commerce, National Bureau of Statistics and State Administration of Foreign Exchange in August.

The first eight months saw Chinese investment in the US increased 18.2 percent from the same period a year earlier, according to the ministry.

"Chinese investment in the US is likely to reach $3 billion or $4 billion in 2012 and the potential is $10 billion in the future. Several substantial Chinese companies are now in talks to invest in coal mining in Montana with an initial $2 billion to $3 billion and export the coal to China," Seyedin said.

Jennifer Zimdahl Galt, consul general of the American consulate in Guangzhou, said the US will be a very attractive investment destination for Chinese investors owing to its favorable economic environment, mature and open market as well as the efforts of SelectUSA, an agency established by US President Barack Obama in 2011 that seeks to highlight many advantages the United States offers as a location for business and investment.

Seyedin countered any fears of increasing Chinese investment in the US and said: "We are wide open to Chinese investment and there is no way for China to have all our products and there is no way for China to have all our technology because the Chinese economy and innovation is only about 20 years old."

Seyedin did not see hurdles for Chinese investment in the US and said: "The problem is to understand the market, the culture, the tax structure and the legal system. The first and the most important step for Chinese companies to make is to hire an accountant, a lawyer and people understanding both cultures. If they do all these things right, most of them will succeed".

Despite having an optimistic outlook on China's overseas investment, Arthur Wang, a global partner with McKinsey & Co, said there are still challenges facing Chinese managers in their overseas operations.

Apart from the traditional obstacles such as cultural differences, one of the major issues is to find the right balance in the elasticity of managing overseas units.

To that end, Chinese companies need to raise a group of top and middle management with international business experience and language skills. "At the moment, the lack of such talent is the biggest challenge facing ambitious Chinese investors," Wang said.

Victoria Tang, associate director-general of InvestHK, said with an excellent service system in finance, law, accounting, insurance and branding, Hong Kong can play the role of a platform to assist mainland investors in meeting various demands and achieve their "going-out" strategies.

Meanwhile, she said, Hong Kong has talent resources with global vision and knowledge of the mainland market and can be a "drill ground" for Chinese enterprises with global ambitions.

GDP to GNP

Apart from the efforts of the companies themselves, economists are also calling for more support on the policy level for China's overseas investments, which may require a fundamental change in China's economic structure.

Ba Shusong, an economist with the Development Research Center of the State Council, said one of the major challenges facing the Chinese economy in the coming years is the diminishing demographic bonus and a constantly rising labor cost as a result.

"Therefore, preparing early and moving out of the low-end processing and manufacturing industries will be beneficial for the Chinese economy," Ba said.

Meanwhile, he said, the ongoing urbanization process in China as well as the improving living standards of people both require massive consumption of resources. As a result, a global investment strategy for resources is necessary for the long-term benefit of the Chinese economy.

Over the past 30 years, the evaluation of the gross domestic product has played a major part in how local authorities are assessed. This "GDP worship" has made its contribution to China's economic soaraway success but has also been blamed for social and environmental problems caused by development for the sake of development.

For the next stage, faced with increasing pressure for economic transformation and expanding outward investment, Ba suggested changing the assessment criteria for local governments from GDP to gross national product.

GDP defines production based on the geographical location of production, whereas GNP allocates production based on ownership.

While GNP measures the output generated by a country's enterprises (whether physically located in China or abroad), GDP measures the total output produced within a country's borders - whether produced by that country's own local firms or by foreign firms.

When a country's capital or labor resources are employed outside its borders, or when a foreign firm is operating in its territory, GDP and GNP can produce different measures of total output.

The two abbreviations only vary in one letter, but the actual differences are way bigger.

Despite a rapid economic expansion over more than 30 years, ordinary Chinese citizens' welfare hasn't grown very much compared with Japan and the Republic of Korea. These countries enjoyed a big share of China's economic growth from their investment in China.

"Japan's GDP growth may be weakening but its GNP growth may not be as low considering the revenue of its massive investments in China and other major economies worldwide," Ba said.

According to statistics from the Ministry of Commerce, Japan was the third largest regional investor in China as of 2011, only after Hong Kong and the British Virgin Islands. The realized FDI value was $79.9 billion as of 2011, which accounted for 6.5 percent of the total FDI in China.

The trend is also seen within different provinces in China.

In recent years, the traditional economic powerhouses, such as Beijing, Shanghai, Jiangsu, Zhejiang and Guangdong, are now ranked among the lowest on the country's GDP growth table, whereas provinces in central and western China are seeing faster growth rates.

Apart from the fact that the eastern provinces are witnessing a slower year-on-year growth due to their larger cardinal numbers in previous years, Ba said that another major reason to explain this phenomenon is that enterprises in the comparatively developed regions are going abroad and seeking business opportunities overseas.

"Even if the GDP growth of these provinces is slowing, the GNP growth might not be necessarily slowing," he said.

To encourage overseas investment, Ba suggested attaching more importance to GNP in the assessment criteria for local governments, thereby bringing in a global vision for local authorities and offering more support to the overseas investment resources.

Sheng Songcheng, head of the statistics department at the People's Bank of China, said growing overseas investment brings an opportunity for China to open up its capital account. The capital account includes FDI, portfolio and other investments, plus changes in the reserve account. The capital account and the current account together constitute a nation's balance of payments. Since large capital inflows or outflows can have destabilizing effects on a nation's economy, many countries have controls in place to regulate capital account flows.

When Chinese companies or individuals want to explore overseas markets and purchase business units, materials or energy, they will all have to act in concert with the opening up of the capital account.

With the country's more than $3 trillion foreign exchange reserves and an obvious overcapacity in domestic industrial sectors, opening up the capital account will benefit the transformation of the world's second largest economy.

Qiao Yide, secretary-general of Shanghai Development Research Foundation, said China's GDP has been more than its GNP during the past 30 years because of the policy to attract foreign direct investment and because there had been little revenue from its overseas investments. But the gap between the two has now got to be narrowing.

During that process, both statistical indexes should be used as a reminder of the level of China's internationalization, Qiao said.

He Dong, executive director of Hong Kong Monetary Authority, said the GDP growth in China will gradually slow and foreign investment will be a big source of the nation's wealth in the future.

However, he said, the success of this goal depends on the opening-up of the capital account.

The income from overseas investment is only currently 0.5 percent of China's GDP at the moment, whereas in Japan, where private investors can invest directly overseas via its open capital account, the figure is 2 to 3 percent of GDP.

Updated: 2012-10-22 09:04