Margaret Ferte spends hours every day on her ever-expanding website, expatmedicare.com, which she registered in Shanghai three years ago to serve the expatriate community's increasing need for medical insurance.

|

|

An European woman consulting Chinese doctors at a hospital in Hangzhou, Zhejiang province. China's growing number of expatriates has created an emerging high-end private healthcare business market for insurers at the same time as medical and health insurance are being promoted through the country's medical reform. [Photo/China Daily] |

It is a sign of the rising significance of the sector.

The website gives a comprehensive introduction to international medical insurance, including benefits, premiums and healthcare tips. It has two hotline numbers to attract potential clients from the Chinese mainland and Hong Kong.

"We work closely with clients to review their individual needs and, from there, we research the market for the best solutions to fit the demands. Our service also includes claim management. That is helping customers with their medical claims," she said.

Ferte links insurance providers with buyers but the brokerage is paid by insurance firms rather than individual clients. "Our service is free so our advice is independent and non-biased," she said.

Built from scratch, the startup has grown quickly with 10 staff servicing about 500 expat clients in China and working with 10 medical insurance providers across the country.

Over the past decade, the growing number of expatriates in China has created an emerging high-end private healthcare business market for insurers at the same time as medical and health insurance are being promoted through government reforms.

However, it is only relatively recently that overseas companies have entered China's private health and medical insurance market, either by acquiring equity stakes or in forming partnerships with leading Chinese insurers.

Such deals include South Africa-based Discovery Holdings acquiring a stake in Ping An Health Insurance Co of China, a subsidiary of Ping An Insurance (Group) Co of China in 2009. Also, Germany-based DKV Group, part of Munich Re, jointly set up PICC Health Insurance Co with the largest Chinese nonlife insurer, People's Insurance Company of China in 2005.

In August, Allianz China General Insurance Co, a wholly owned subsidiary of global insurance and asset management provider Allianz Group, entered China's health insurance market by forming a joint venture with Allianz Worldwide Care, the medical insurance arm of the corporation.

Based in Dublin, Allianz Worldwide Care specializes in providing international health insurance for employees and their dependents worldwide. The company structure, product design and support services have evolved specifically to anticipate and meet the health insurance needs of corporate clients.

According to Ron Buchan, chief executive officer of Allianz Worldwide Care, the firm aims to offer a range of international healthcare plans designed to appeal to both international and local corporate groups in China.

The point is there is a strong and increasing demand for quality international health products, Buchan said.

"Traditionally in the Asia-Pacific region, Singapore and Hong Kong were the two chosen hubs for multinational corporations' headquarters but the past five years have seen people moving their headquarters to Beijing and Shanghai," he added.

He said the Chinese business landscape will entertain more joint venture companies and many Chinese companies will be sending their people abroad, increasing demand in the sector.

|

|

Chinese patients lining up to see doctors at a hospital in Harbin, capital city of Northeast China's Heilongjiang province. While the country is now pouring record amounts of its wealth into health services, it does not run a fully State-funded cradle-to-grave system. Its basic medical insurance covers about half the costs of healthcare, leaving the remainder paid either by patients or their health insurer. [Photo/China Daily] |

Clients are offered a flexible selection of comprehensive plans that cover a wide range of in-patient and day-care treatments, as well as other benefits such as medical evacuation, local ambulance and nursing at home.

"We have adjusted our plans to include, for example, the use of traditional Chinese medicine to reflect the market needs of Chinese people," Buchan said.

Burgeoning business

Allianz's timely decision to offer their very first Chinese-compliant plan allows people in China to buy locally and pay with yuan.

But influential as Allianz is, its health insurance business is very much a latecomer to China.

While many insurance firms recognize the increasing allure of the vast Chinese market, it has only been in the past four years that they began jousting with each other for a share of it, said Zhou Xiye, regional vice-president of global health benefits for Cigna and CMC Life Insurance Co.

Zhou's company is a joint venture established by United States-headquartered insurance provider Cigna Corp, an industry heavyweight specializing in health insurance. It established itself in China in 2003.

"Generally we had two concerns. At first we were not sure whether the market had that much potential but, as expats kept flocking to the country, and companies started using comprehensive healthcare plans as a benefit tool to attract key local talent, we decided to take the first move targeting high-level corporate clients," Zhou said.

The business soon saw a meteoric rise: It enjoyed a compounded growth rate of more than 100 percent in terms of the number of new orders and revenue generated from premiums jumped to second place in China from 2009 to 2011.

Currently it works with more than 200 companies, a majority of which are Fortune 500 firms.

The second concern, Zhou said, was the so-called "return-conscious" mindset that was unique to the Chinese market and that has everything to do with the current social health insurance system.

While the country is now pouring record amounts of its wealth into health services, it does not run a fully State-funded cradle-to-grave system. Its basic medical insurance covers about half the costs of healthcare, leaving the remainder paid either by patients or their health insurer.

This product is known as "group supplementary health insurance" and is the most widely sold health insurance in China.

But Zhou said a "high-end medical insurance" differentiates itself from the group supplementary insurance by reimbursing all medically necessary expenses that fall out of the limited social health insurance plans.

"In general, there is inadequate access to top-tier hospitals and healthcare facilities because patients generally end up paying 60 percent out of their own pockets and often struggle to gain access to high-end care," he said.

While the market gap and the increasing demand do provide growing space for Western insurers, Chinese people usually buy savings-type or high-return products rather than health insurance.

"If one pays extra in addition to the basic social insurance, he or she would like to get a decent return. Chinese clients tend to think of it as pure investment instead of the leverage of risk. That kind of culture has dented its growth," Zhou added.

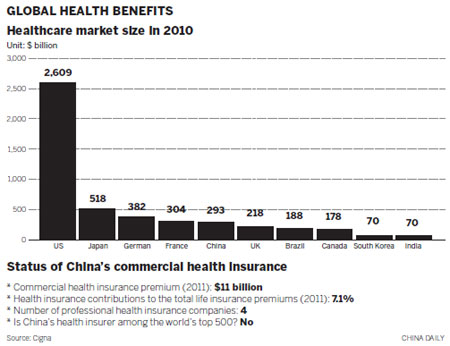

According to a McKinsey & Co study, China's healthcare market in 2010 was valued at $293 billion, ranking it fifth worldwide. In sharp contrast, the commercial health insurance premium in 2011 amounted to just $11 billion, accounting for less than 4 percent.

China's health insurance premiums claimed a mere 7.1 percent of overall life insurance premiums, McKinsey data showed. In developed economies, the figure usually amounts to 30 percent, Zhou noted.

International medical insurance is "hugely lacking" in the Chinese mainland, where local general medical policies do not cover treatment outside the mainland, making them unappealing to both Chinese customers who travel overseas and expatriates stationed in the mainland.

The majority of the market is still competing with products covering major diseases and those that are subsidized by hospitals, Zhou said, whereas high-end health insurance is genuinely a network-type medical product offering seamless services.

Service-centered

John Williams, managing director of International SOS's China operations, a global medical and security service company, is starting to feel the pinch from top-end Chinese hospitals that are aiming to grab a share in the embryonic high-end medical care market.

International SOS is a membership organization that primarily works with companies to provide medical services to organizations and their employees, but it also collaborates with credit card companies and insurance firms to enable their clients to get access to international-standard medical facilities.

It opened an office in Beijing in 1989 and currently runs four clinics in Beijing, Tianjin and Nanjing. But Williams admitted the whole medical situation in China has changed very quickly over the past 10 years, especially in East China's coastal areas, saying there is a much more competitive business environment.

"The health bureau is encouraging the development of more community facilities because the hospitals are very busy with the volume of patients. Now many smaller clinics are run and operated by the Chinese," he said.

There are also many more options available than a decade ago. An increasing number of high-end facilities are embedded in Chinese local hospitals, such as the VIP unit in China's triple-A hospitals that have English-speaking doctors trained overseas, Williams said.

David Hayes, sales director of insurance brokerage Pacific Prime Insurance Brokers Ltd, is well positioned to echo such observations. His firm deals with individual insurance cases and he has noticed more patients are inclined to visit Chinese-run hospitals.

"Foreigners just want to speak English especially when they are sick. That's where the foreign facilities stand out. But the quality of Chinese facilities has significantly improved, notably those that run sections for foreigners," he said.

From time to time, Hayes said, foreign-owned facilities transfer a patient to a well-known local hospital if they are in a critical condition because he or she may get a better diagnosis and treatment.

For example, International SOS partners with around 600 hospitals nationwide on contract. The purpose, Williams said, is to send doctors to those hospitals and get to know better their standards and facilities should their members need access to the facilities, in the event of an emergency.

"Foreign facilities, such as Parkway and United Family, are sometimes incredibly expensive. For clients to feel safe, comfortable and with no language barrier, a good Chinese hospital is equal to, if not better than, a foreign one. This has happened over the past four years," Hayes said.

But choosing an insurance firm is a different story. The core competence in high-end medical insurance lies in the combination of network resources and localization abilities, according to industry insiders.

Buchan from Allianz is confident his company can leverage the comprehensive network of medical providers overseas to help clients access medical facilities in the shortest possible period of time.

It has a multilingual helpline and an "on-the-ground" doctor for additional support and advice for each policyholder. "This is the real advantage we have over local insurers," he said,

Likewise, Cigna has close ties with more than 100,000 healthcare providers outside its US headquarters and runs eight service centers 24 hours a day, seven days a week worldwide.

Usually a broker would recommend a customer depending on his or her budget and needs, said Ferte of expatmedicare.com in Shanghai, but clients still opt for foreign-owned ones for better coverage.

"Yes, we do recommend Chinese insurance companies but most clients prefer foreign firms, even though Chinese insurance companies are more competitive," she said.

"The thing is, local insurers' services outside China are not as strong compared with foreign ones and expats are looking for international coverage when they travel or return home."

According to Hayes, people generally get what they pay for in terms of medical insurance. While big-name insurers such as Cigna, Bupa or Allianz, provide comprehensive coverage, age, budget and gender become three decisive factors in choosing products.

A 20-year-old lady would be charged less because of the low likelihood she would develop chronic conditions, he said.

"But if you are a 30-year-old housewife and considering having a baby, you may want to get a Cigna plan with maternity cover included. Certain insurers are good at certain things and, in terms of the benefits, we will help you read between the lines," he said.

Changing market

Two demographic changes have become a critical impetus to the development of high-end medical insurance in China.

The market changed dramatically with a lot more young expats coming to the country so the percentage of highly paid expats fell.

"We are definitely seeing a lot of people who arrive here in their early 20s. With a lot of Mandarin being taught in universities, they think that Asia, particularly China, is the place to be right now," said Hayes of Pacific Prime Insurance Brokers Ltd.

Ferte also sees a growing number of local hires where medical insurance is not part of the package. "What they can afford is not as much as senior expats but the volume is impressive."

As a result, many insurers have introduced tier-plans to cater to varied needs. For instance, Cigna has launched a new insurance package titled Jade in addition to its existing silver, gold and platinum plans, targeted at entry-level buyers.

If you are a 22-year-old Frenchman teaching a language in China, Hayes said, you wouldn't want to get a Cigna or Allianz full package because you could ill afford it.

On the contrary, as most of these young and junior foreigners are on local packages, it increases the demand for local insurance, most likely major medical hospitalization plans. That has prompted insurers to design products with that in mind.

The other shift is the growing awareness of quality medical services by the booming Chinese middle class.

Buchan believes more Chinese will in the long-term start operating businesses overseas. When sending staff and their families abroad, Chinese firms are expected to cover their employees so they can access the best medical facilities available.

However, more are eyeing the local market. Hayes' office has developed a Chinese sales team with eight employees targeted specifically at the local market.

"We have about 15 percent of Chinese (as our clients) and we expect that number to soar over the next three years," he said.

The insurance business will unlock its full potential only when more Chinese start swimming with the tide, said Hayes.

Cigna's Zhou said about half of his company's 7,000 clients are Chinese nationals. Four years ago all policyholders were overseas people.

"We have seen an increasing number of international medical centers, foreign and VIP sections in public facilities and extensive use of advanced medical equipment and imported drugs. More customers can and are willing to afford top-up cover," he said.

"Once Chinese people are more aware of the benefits of high-end medical insurance, it will be an exciting and competitive market," Zhou forecast.

After all, the term high-end medical insurance is "misleading", he added.

"It is not luxury medical insurance. On the contrary, it is real medical insurance."

Updated: 2012-10-08 09:42