So what's the good news? One key measure will benefit more than 24 million people, though only by 90p a week (don't spend it all at once). This is because the chancellor has upped the amount working people can earn before paying any income tax.

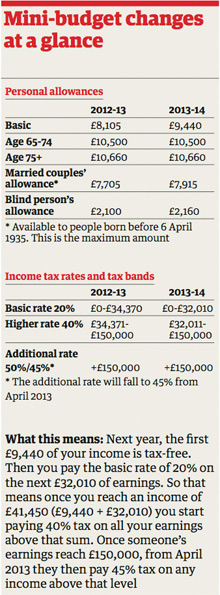

How? By tweaking the personal allowance – that part of your income on which you don't pay tax. The allowance was due to rise from £8,105 in the current tax year to £9,205 in 2013-14, but Osborne said it would now increase by £1,335 in April 2013 – £235 more than previously announced – so no tax will be paid on earnings of less than £9,440.

The chancellor claimed this was "a direct boost to the incomes of people working hard to provide for their families. That's £47 extra in cash next year." And the move will take an additional 250,000 low earners out of the tax net.

But when I looked at my latest PAYE coding notice, I'm pretty sure the figure on there was less than £8,105. For many workers, their total tax-free amount will be less than their personal allowance. That's to do with the fact that if your employer provides you with company benefits or perks, such as medical insurance or a car, you will probably have to pay tax on them. HM Revenue & Customs will usually include the value of the benefit in your tax code so they can collect the tax due through the PAYE system.

Suppose you are entitled to the basic personal allowance of £8,105, and your employer has provided you with private medical insurance worth £600. Therefore your deduction is £600 (the value of your medical insurance benefit), which means your total tax-free amount is £7,505. That appears as a tax code of 750L.

So what's the bad news? There's a fair bit. The rise in the personal allowance from £8,105 to £9,440 gives the average taxpayer a £267 gain (it was originally going to be £220, hence the £47 extra referred to by Osborne). But for many poorer families, this gain could shrink to £40 because they will lose some of their means-tested benefits as a result.

The Low Incomes Tax Reform Group (LITRG) says: "People on means-tested benefits whose benefit entitlement is based on after-tax income may not be very much better off overall. If their after-tax income goes up because they are paying less tax, their benefits may fall."

It gives the example of a sole earner with a partner and child who earns £9,500 a year. In 2012-13 they were paying £507 in income tax and national insurance contributions. In 2013-14 they will pay £222, but that saving could be reduced by up to 85% because of the decrease in their entitlement to housing benefit and council tax benefit.

Any more bad news? Yes. Osborne didn't highlight it in his speech, but millions of older people will not be pleased by what's happening to their allowances. Anyone over 65 currently has a much higher personal allowance than those in work – £10,500 for the current tax year, or £10,660 for those aged 75-plus. It has already been announced that from April 2013 these will be frozen. So these amounts will stay as they are in 2013-14.

The LITRG says that those who have already qualified for the higher age allowance will see no increase in future years until the level of the basic personal allowance catches up. Robin Williamson, the group's technical director, says: "Although nobody will lose in cash terms, those approaching 65 now may have to revise their expectations and prepare to pay more tax than they might have anticipated. And more pensioners could be drawn into self-assessment as a higher proportion of those reaching 65 become, or remain, taxpayers than in previous years.

"Also, by freezing those who are entitled to the increased age allowances at their 2012-13 level, some pensioners will become worse off in real terms as their pensions are indexed over the next few years."

But, he adds, a small group of middle-income older taxpayers will be marginally better off, because the level at which the age-related part of the personal allowance begins to be withdrawn has not been frozen. That threshold is £700 higher in 2013-14 than in 2012-13, up from £25,400 to £26,100.

Is that it for the grim tidings? I'm afraid not. There was a blow for many workers with the news that 400,000 more middle-income earners will be dragged into the 40% tax band over the next two to three years. That is because the higher rate income tax threshold will rise by just 1% in 2014-15 and 2015-16, so the income at which people start paying the 40% rate will rise from £41,450 in 2013 to £41,865 in 2014, then to £42,285 in 2015.

This 1% increase is, of course, less than wage and general inflation. "In practice, this will mean more taxpayers drawn into the higher rates and a continuation of the fiscal drag we've seen in recent years," says Tony Bernstein at chartered accountants HW Fisher & Company.

The Treasury admits that compared with uprating the higher rate threshold by inflation "these changes are expected to create around 400,000 more higher rate taxpayers by 2015-16". But it claims that, taking into account the income tax changes announced since 2010 "these new higher rate taxpayers will typically be over £270 better off in real terms over the parliament".

Francesca Lagerberg, head of tax at Grant Thornton, says: "There's to be a glacial uplift in most of the well-known allowances and thresholds over the next two years. This is not linked to inflation, but is broadly a 1% increase. The good news is that these items have not been frozen. The bad news is that there will not be a significant uplift except for the personal allowance, which … is on target to hit the hallowed £10,000 before the end of this parliament as promised."